By 2019, after years of declining ridership and much speculation as to the cause, transit use began increasing in regions such as New York City and Washington, DC.

The American Public Transportation Association’s (APTA’s) most recent public transportation ridership report showed an increase in public transit ridership in the last three months of 2019, with ridership up by nearly 1% nationally.

APTA has yet to release a report for the first quarter of 2020, but it will show a dramatic dip in public transit ridership across all modes and systems in the United States. Some apps such as Transit App already show a precipitous drop in ridership based on number of app opens. These drops result from millions of Americans being under mandatory stay-at-home orders during much of March and nearly all of April, with many states still in some form of lockdown through May.

Unsurprisingly, news stories abound of public transit agencies struggling financially. Ridership has plummeted and critical non-farebox funding sources such as sales tax have suffered as well; these stories have stoked fears that transit faces an existential crisis unlike any it has ever encountered.

In response, transit systems across the United States have curtailed services. Amtrak’s Northeast Corridor, the financially critical infrastructure for millions of travelers in a region that constitutes the fifth largest economy in the world, drastically reduced its service due to an unprecedented decline in daily riders.

Commuter rail, another key service across the United States and in the bustling Northeast Corridor, has been hit harder than bus, subway, or light-rail systems as telework has removed millions of riders.

Additionally, the auto industry may find a new market with buyers who previously rode transit or used ride-hailing services but stopped because of fears of contracting COVID-19. A recent survey from Cars.com found that “20% of people searching for a car said they don’t own one and had been using public transit or ride hailing.”

With some states loosening restrictions, transit operators are thinking about what comes next, including whether they will see the return of all, most, or only some riders and at what pace these riders will return.

Recurring and stated preference survey data will reveal rider perceptions and their willingness to return to transit

Many questions remain for besieged transit operators. The COVID-19 pandemic has created myriad challenges, some of them out of the control of agencies. Even with the prospect of additional emergency federal funding support for transit, challenges will persist.

Ensuring public transit remains widely useful requires understanding where riders are now—and where they are going—in terms of their preferences, perceptions, and needs. To that end, here are three strategies your agency can consider so you are better positioned to retain and reclaim ridership as the COVID-19 pandemic evolves:

- Repeatedly survey current and former riders about mode choice, travel behavior, and preferences as conditions change. Only a fraction of former riders currently still take transit. However, as national and local conditions and restrictions change, these former riders will start reassessing their mode choices that just three months ago were habitual and second nature. Your agency likely has contact information for riders; survey riders using this list. While passively collected data (“big data”) and information gleaned from Google/Apple/Moovit can be useful for describing existing travel patterns, proactively surveying current and former riders now will help ensure that these former riders return. By doing this, your agency will also be able to investigate the type of rider that is/is not on transit and, importantly, how their travel choices and preferences will evolve over the next few months as travel restrictions and social-distancing guidelines change.

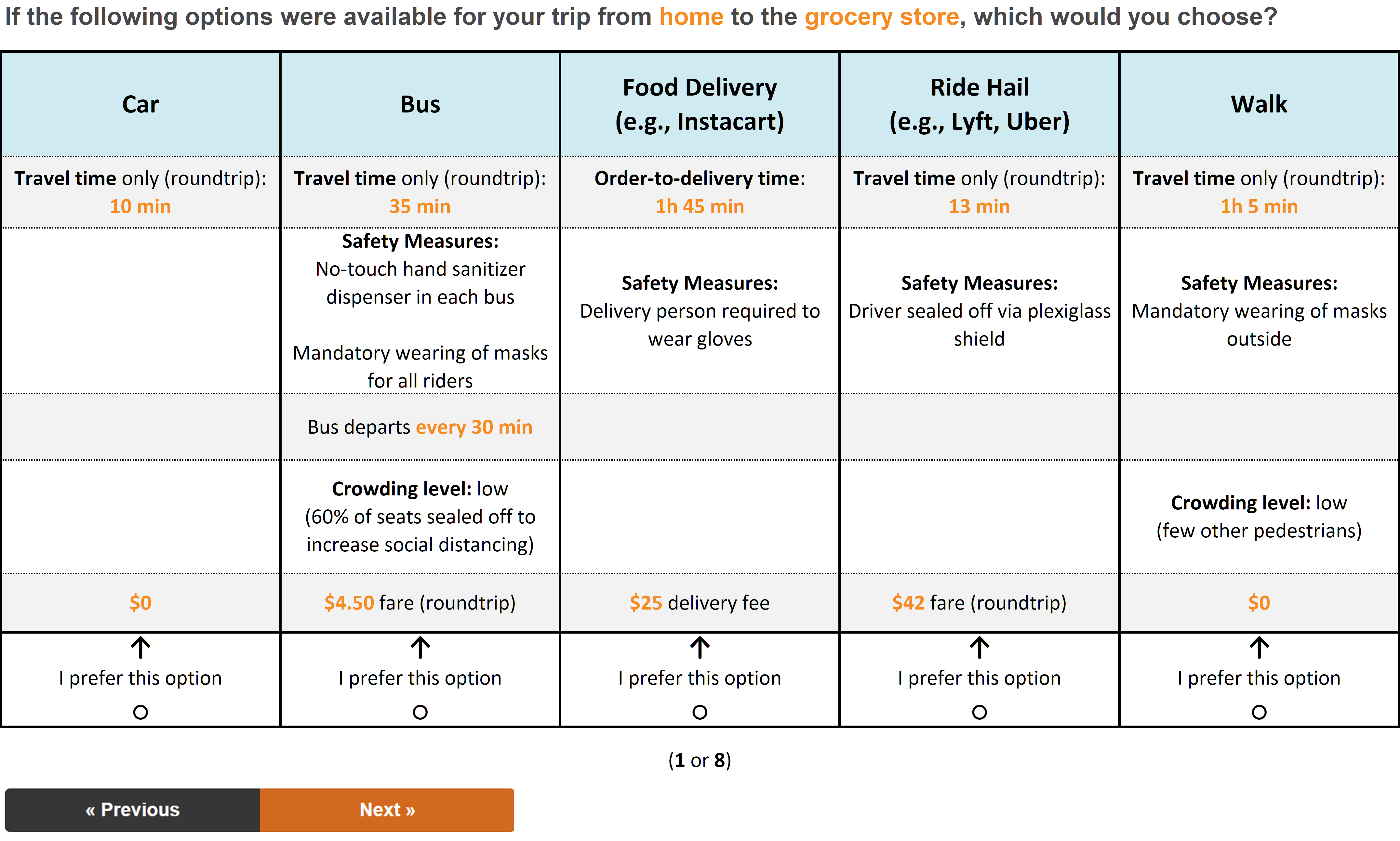

- Use stated preference surveys to help investigate how mode choice differs by trip type, which is likely to have been directly affected by COVID-19. While regular panel surveys can provide good insights into people’s travel behaviors, stated preference surveys allow your agency to become an active agent in shaping and choosing those services, policies, and actions that most resonate with riders. Mode choice—or whether to even make a trip—will be influenced by trip type (e.g., commuting for work, getting groceries, shopping). Stated preference surveys should therefore not only differentiate between trip type, but also ask about discretionary trips, how common trip substitutions are perceived (e.g., telecommuting, home deliveries, and online shopping), and how transit factors into people’s decision-making when making “nonessential” trips. Surveys could also ask respondents who had and still have the option to work from home whether they plan to continue teleworking or resume commuting.

- Focus on what is under your control: Survey riders about their preferences for safety measures your agency has enacted to see which ones can regain their trust. Importantly, stated preference surveys (example depicted below) also allow your agency to assess passengers’ preferences and perceptions around transit public health measures such as temperature checks, face mask requirements, vehicle occupancy limits, and increased facility sanitization, among other measures. This could help in tailoring safety measures, which your agency has more control over, to meet the preferences of passengers. Again, since these preferences and needs are likely going to change over the next few months, repeatedly reassessing customers’ preferences will be important in this regard to win back riders’ trust and remain competitive with other modes. Additionally, you may consider what else is under your control, including scheduling. For example, Beijing is experimenting with a mobile app booking system for subway riders that requires them to make appointments in advance to help control crowding. Understanding how riders perceive such systems will help gauge their effectiveness.

Stated Preference Mode Choice Example with Potential Safety Measures

By asking these questions now and in a recurring fashion, your agency can begin to understand which measures and actions will regain trust and win riders back over time. Since complex behavioral factors are at play, it is not as simple as resuming service and hoping for the best. Agencies must proactively engage with their customers to address their concerns and meet them where they are.

Collecting these data will help transit pivot to meet the challenges of a post-COVID-19 world

After years of decline, transit began to rebound in 2019 only to face a previously unimaginable dip in ridership in 2020 due to COVID-19. While the reasons for the recent precipitous drop in ridership are clear, the path forward remains opaque for many agencies.

Conducting research that is targeted, tailored, and recurring will position transit to emerge from this crisis on firmer footing than it might have otherwise. These data could help inform strategies around how to maximize ridership and operations in a safer manner as COVID-19 diminishes and the economy reopens.

Importantly, understanding the specifics around which transit users will come back, and when and where they will travel, will help agencies prioritize restoring certain services at higher levels than others. This will help ensure agencies have enough service to allow for social distancing (to avoid crowding) while also pulling back on markets that may never return to pre-COVID-19 levels of ridership (if some workers continue to telework rather than commute).

Now is the time to begin data collection to meet the new contours of demand that emerge after COVID-19. Not doing so risks further alienating returning riders who encounter long waits, crowded vehicles, or inconsistent schedules, thereby exacerbating any shift away from transit.