RSG launched a nationally representative, longitudinal panel survey to reveal the immediate and lasting effects of COVID-19 on travel behaviors in the United States and quantify how people’s sentiments and choices change over the course of the pandemic. The first wave of the COVID-19 Transportation Insights Panel (TIP) began in May and asked respondents about their current travel behaviors over the previous seven days and in mid-March (before the national emergency declaration). TIP supplements the more geographically focused COVID-19 survey research that RSG is conducting for New York City, Minneapolis–Saint Paul, and other major metropolitan regions.

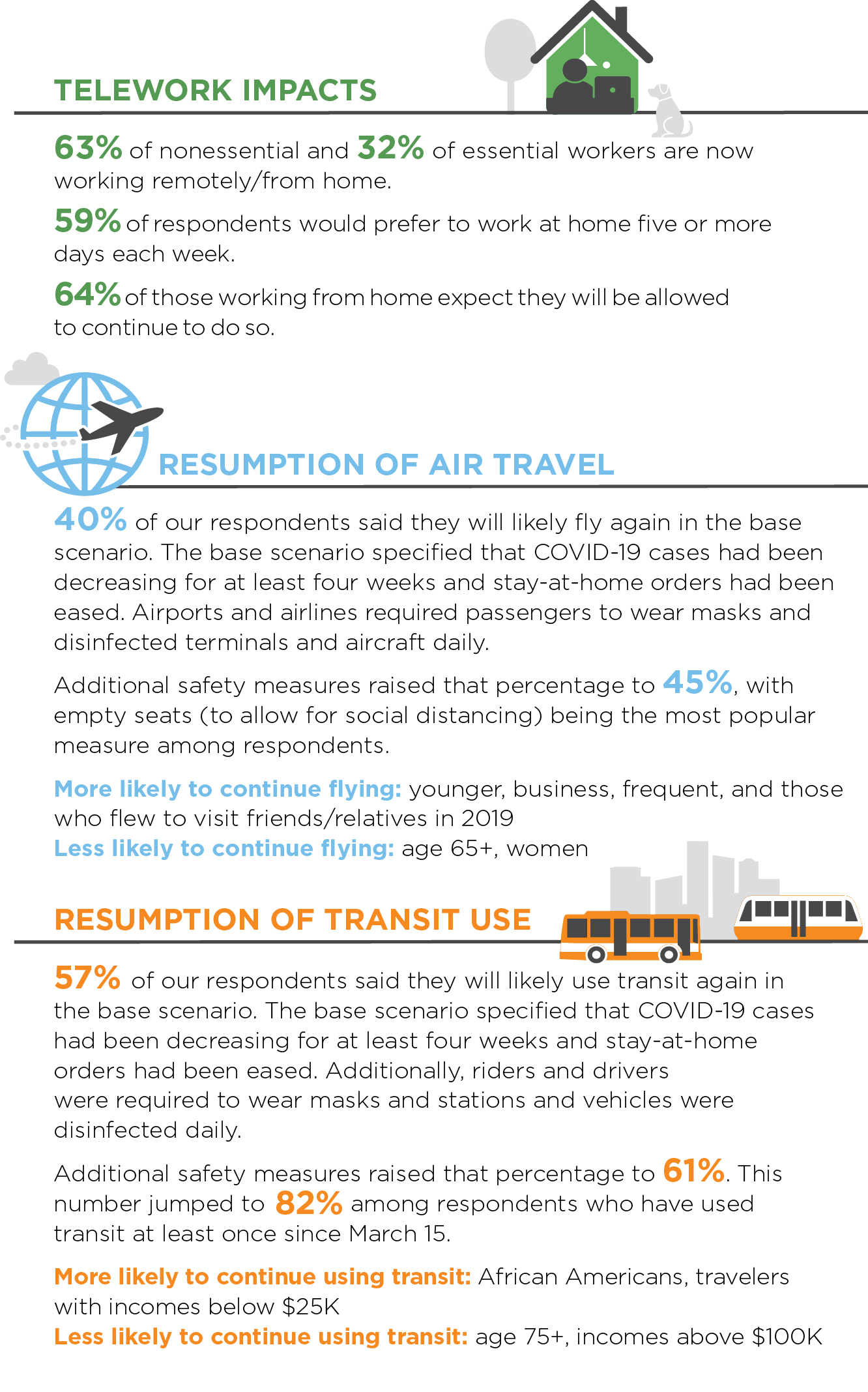

TIP includes questions designed to elicit information about how people are adapting their commuting, recreation, and shopping behaviors in response to the ongoing pandemic and social distancing guidelines. Questions on telework help quantify the potential permanence of work-from-home arrangements as physical locations slowly reopen across the country. It also includes attitudinal questions to help gauge the public’s perceptions of various health and safety measures in the context of air travel and transit use.

As the pandemic continues, understanding the who underlying observed travel behaviors will become increasingly important. To plan accordingly, metropolitan planning organizations, state departments of transportation, and local planning agencies need to understand how the demand for specific types of travel will change as people’s responses shift over time.

Although aggregate travel information is publicly available from analysis of passively collected data (“big data”), these analyses do not provide the level of geographic or behavioral specificity that planning agencies often require to inform their planning activities. Moreover, these existing data often do not provide information on causal connections that could help agencies anticipate and plan for future scenarios based on specific populations within the regions they serve.

Future TIP waves will collect similar data to facilitate comparison between results and identify trends over time, but new questions may be added (and additional waves commissioned) depending on how long the pandemic continues. RSG is also offering agencies the option to add sample to TIP as part of future waves; agencies may also elect to use their existing email lists or panels to administer a custom panel within their own region.

The first wave of data has already highlighted important trends in behavior that will help inform and shape agencies’ responses. These early insights, some of which are highlighted here, offer a glimpse into what the “new normal” may look like and will aid practitioners seeking to adapt travel demand models and future planning activities to current atypical travel behaviors.

Longer commute lengths do not increase desire to telework

More people are teleworking now than ever before. Surprisingly, however, longer commutes among TIP respondents did not correlate with an increased desire to work from home more frequently. Some recent studies have also found that commuting acts as a “psychological threshold” between home and work, indicating potential positives (or maybe missed routines) reflected in the TIP data.

Stringent safety measures deter frequent flyers

Airlines and airports are going to great lengths to convince travelers that it is safe to fly by adopting mask requirements for passengers and crew and stepping up sanitization procedures. However, processes that require additional time to check in and board actually reduced the stated likelihood that the most frequent travelers would fly. Such measures required arriving an extra hour before boarding. These responses reveal what additional measures passengers will demand, tolerate, or simply reject by not flying.

Transit can win back more than just transit captives

Transit use plummeted as COVID-19 first spread and more people began to telework. Ridership remains depressed. Interestingly, respondents’ stated likelihood of continuing to use transit is not affected by auto ownership or essential worker status. In other words, those who used transit before March 2020 and say they will return are not just transit captives. This points to opportunities for transit agencies to recapture riders who can use other modes.

What comes next, and how can RSG help?

Future TIP Insights will further explore the scope and scale of the changes underway and highlight discernible longitudinal trends in the data, including whether any statistically significant correlation exists between respondents’ demographic groups and current/expected travel behaviors. Providing practical insights into the who rather than just the what will empower organizations to make informed decisions as the pandemic evolves and adapt their planning and modeling practices to meet the changing travel conditions and behaviors accordingly. We can guide the complex decision-making required to connect these insights to their current practices to deliver actionable results.

······························

Check out our COVID-19 Transportation Insights Panel page for a brief overview and FAQ. You can also contact us to receive a customized survey demonstration to see how TIP can help your agency adapt to the present and plan for the future.